Planning

When working on a migration of Dynamics GP fixed assets to Business Central, you will want to identify which fields you want to transfer from one system to another. It is no secret that there are more fields available in Dynamics GP, which makes the setup in Business Central a bit challenging, but this is where planning pays off.

You will want to match data fields as best as you can; most of the time, the fields to choose from will not be outlined as clearly as in the setup items listed below:

Dynamics GP | Business Central |

Asset Class | FA Subclass Code |

Location | FA Location Code |

Account Group ID | FA Posting Groups |

The FA Subclass Codes, FA Location Codes, and FA Posting Groups are part of the fixed asset subledger setup and will need to be put in place in Business Central before any fixed assets are imported.

At times, you will need to reach back into SQL Server Management Studio to pull the information needed, such as in this sample query below:

Keep in mind that this is a sample query and is available for use at your discretion; it is not inclusive of all Dynamics GP fixed asset data fields but offers a good place to start mapping data fields and prepping the data to be exported out of the SQL Server database.

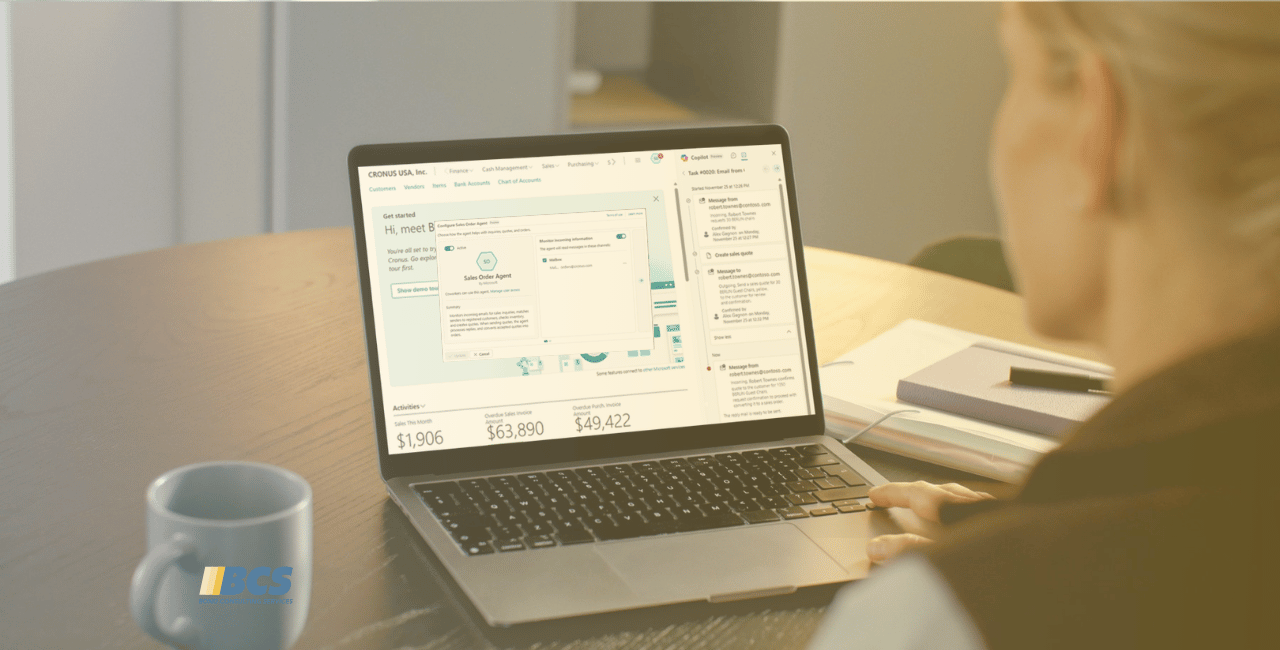

Importing

When it comes to importing fixed assets into Business Central, I tend to lean more toward using a Configuration Package. Although most of the same fields are available via ‘Edit in Excel’, there are fields like Dimension Codes that are not accessible via ‘Edit in Excel’ when importing the General Asset information. By the way, there is a ton of information online that gives you guidance on setting up and using Configuration Packages.

Regardless of the method used for importing fixed assets into Business Central, the information being imported relates mostly to the General Asset fast tab. If available, update the Depreciation Book fast tab related fields, as well; some of the fields available for import are the Depreciation Method, Depreciation Book Code, and Posting Group fields.

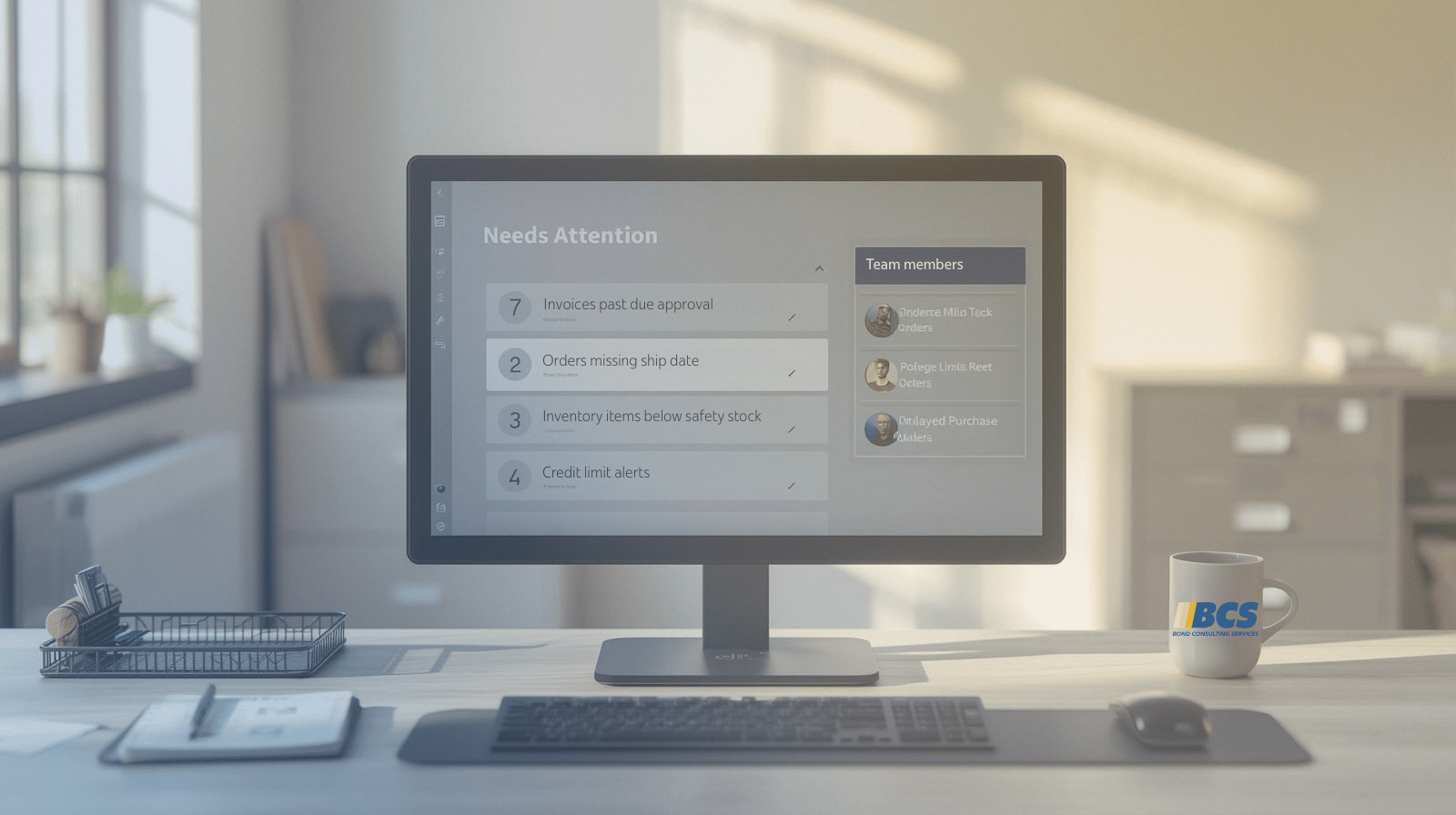

Asset Book Values

Asset book values will need to be managed as a separate step from the General Asset import. Although the General Asset and (partial) Depreciation Book information will be available in the fast tabs, the Book Value balance will remain at $0 until you process a Fixed Asset Journal or Fixed Asset G/L Journal based on your fixed assets module settings in Business Central.

The fixed asset journals/ fixed asset GL journals allow you to post subledger entries that reflect an asset’s value and the corresponding accumulated depreciation. This can be done in one entry, or two (if needed), reflecting the appropriate placed-in-service date and depreciated to date (which correlates with the accumulated depreciation); the net of these posted entries will reflect as the Book Value on the Depreciation Book fast tab.

Key Takeaways for Fixed Asset Migration from GP to Business Central

The better you plan in mapping the fields being migrated from Dynamics GP to Business Central, the less back and forth that will be required between the two systems. Any fixed asset data fields that are missed during the first round of imports can usually be touched up in Business Central with a quick update using the ‘Edit in Excel’ tool.

Ready to simplify your move from Dynamics GP to Business Central?

Migrating fixed assets is just one part of the journey. With proper planning, configuration, and support, you can ensure your entire transition goes smoothly. If you’d like guidance or hands-on help, our team at Bond Consulting Services is here to support you every step of the way.

Contact us today to learn more about Business Central migrations.