Generating revenue is the driving factor for keeping a company in business, but collecting the already promised revenue is just as important and can often be even more challenging. A lot of companies struggle with a labor-intensive collection process that is riddled with inefficiencies. Manual processes often create double entry, disconnect between internal systems, and more risk for human error.

So what does a manual A/R process look like? Here is an example:

• Mail or email invoices individually

• Send reminders to customers one by one

• Collect payment information by mail or over the phone

• Process credit cards through a terminal or take checks to the bank

• Send confirmation receipts

• Enter payments into accounting system by hand

So how can you improve your AR process? Here are 4 ways to get started:

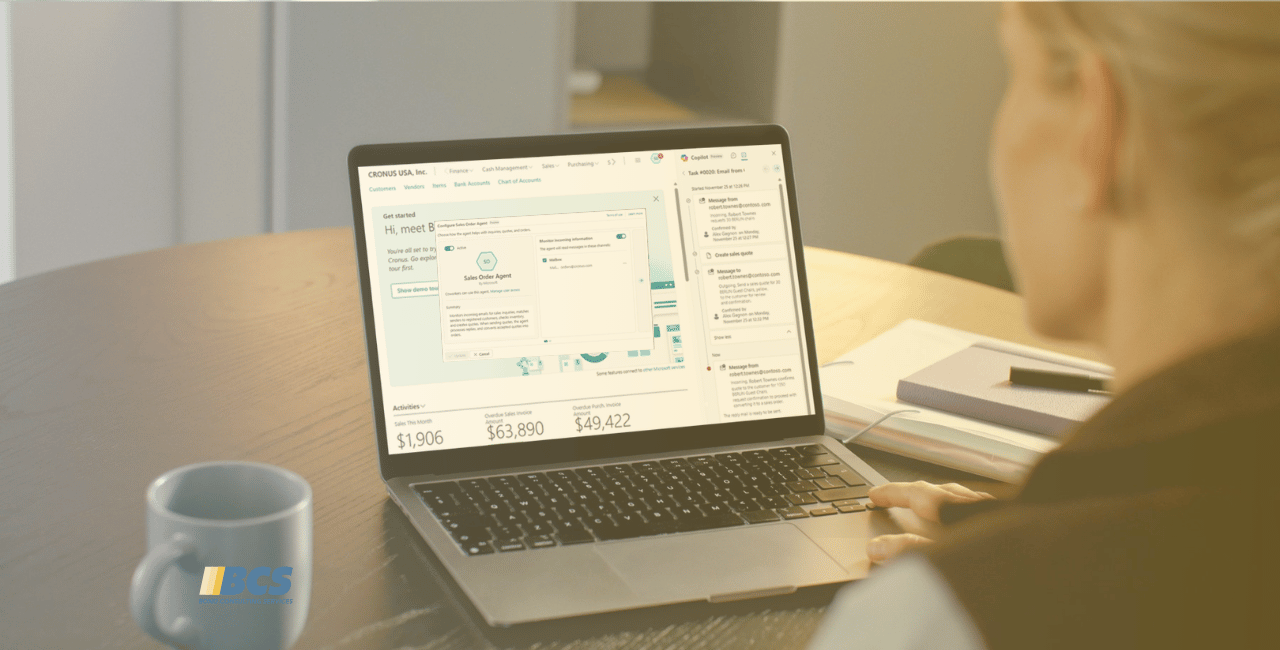

1. Automation

With the latest technology, a lot of these steps can be automated, including the sending of invoices, receiving and applying of payments, and sending of reminder emails and confirmations receipts. In addition, automating your A/R process simplifies reconciliation for both yourself and the merchant.

2. Customer Convenience

Today’s customer wants more control over their payments. ePayments have provided more convenience and efficiency to consumers than ever before. They can:

• Sign up for automatic bill pay to eliminate the hassle of manually paying bills every month and avoid paying late fee penalties

• Schedule future payments and view their historical and outstanding invoices

• Save payment methods in a secure eWallet for easy access during future transactions

Allowing customers to submit payments electronically is also beneficial to the merchant. Electronic bill users are 35% more likely to pay their bills on time and 12.5% less likely to leave.

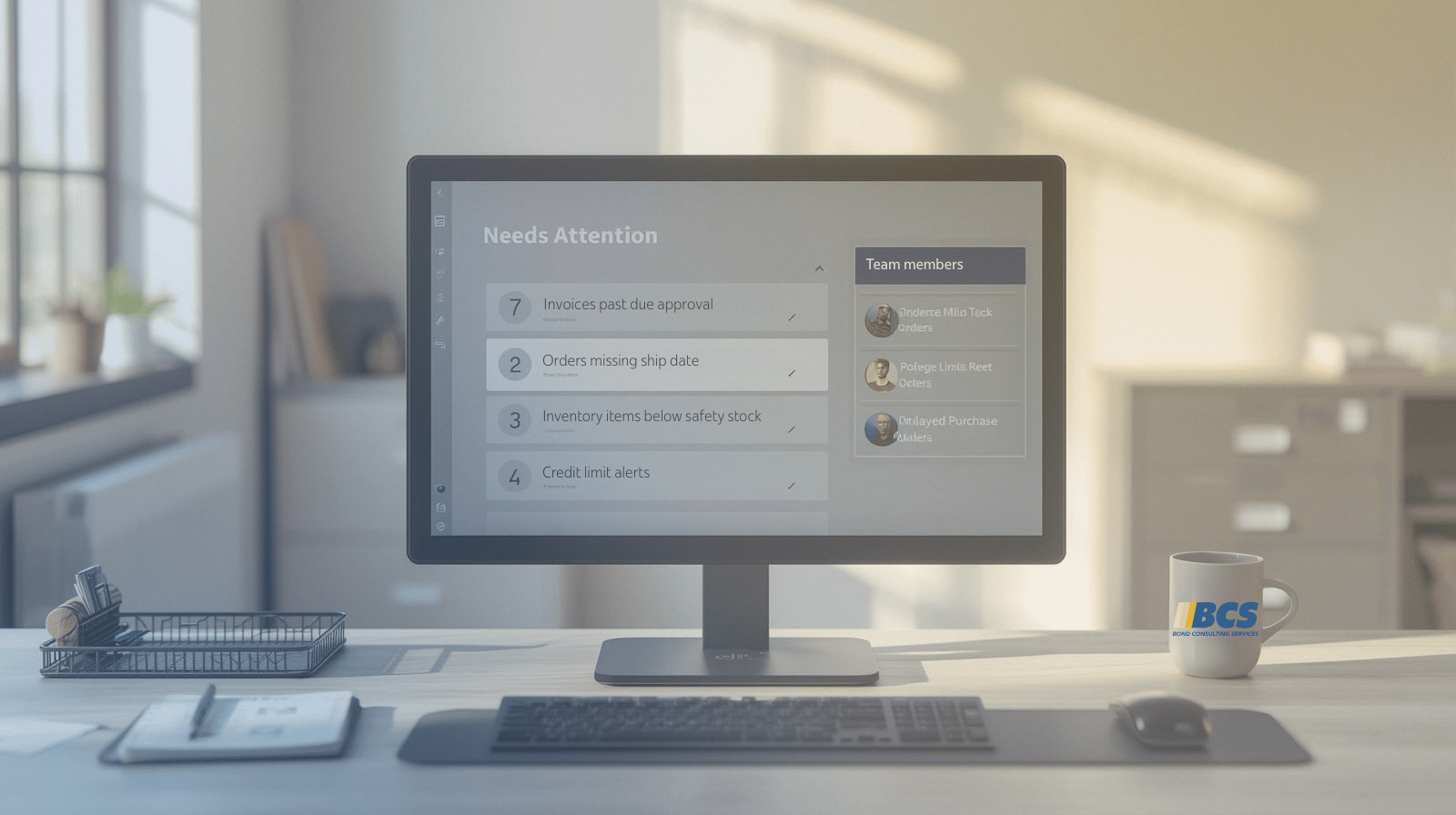

3. Integration

Make sure that the systems and software that you are using are fully integrated with your ERP or accounting system. This will help eliminate double entry, human error, and manual reconciliation. In addition, it will provide real-time reporting, which ensures that you know exactly how much money your organization has collected at any time.

4. Security (PCI Compliance)

A security breach and loss of valuable data can not only result in heavy fines, but it can cause a company to lose the trust and business of returning customers. Any merchant accepting credit cards as a form of payment from their customers is required to abide by the security standard of the Payment Card Industry Security Standard Council, or PCI SSC. Part of the requirements for maintaining PCI compliance is using a payment processing application that is PA-DSS certified. Choosing a solution that focuses on the security of payment information and keeping your company up to date on the latest PCI regulations will greatly decrease the chances of your company falling victim to a security breach.

To learn more about automating your AR process, join our partner, Nodus Technologies, for a free webinar on August 16, at 9am PST.