Why Bank Reconciliations Matter

Within the close cycle, reconciling your cash is the most basic task yet remains vital for accountants on recognizing error or fraud. From an operational standpoint, understanding cash position is critical for organizations to function and management to make decisions. If the bank account is not reconciled, all financial reports are fugazi. A misrepresentation of the true picture.

For most accountants, 90% of the bank reconciliation process can be tedious or repetitive. The remaining 10% will require greater insight (looking at you payroll journal!) Businesses with a large volume of bank transactions are in a much tougher position. For those accountants, the process can be overwhelming and laborious. Words that are all synonymous with burn-out.

Copilot loves Bank Recs

Microsoft’s Copilot AI assistant and Bank Recs is marriage built on accuracy and efficiency. It may not be an obvious match made in heaven, but Copilot and Bank Recs are the new power couple. Turns out, AI is a cash sorting monster and will only get better with use. Across industries, accountants who utilize new AI features can now shift focus from data entry to strategic thinking.

Ready to take the AI leap? Microsoft has got you covered with their introduction of Copilot’s reconciliation assistant for Business Central Bank Accounts. Riding on the coat tails of their Match Automatically function, Copilot removes the cap on what’s possible with AI. Businesses leveraging Copilot’s reconciliation assistant will benefit with greater efficiency, enhanced accuracy, faster closings, and improved scalability.

How Copilot Enhances Bank Reconciliation

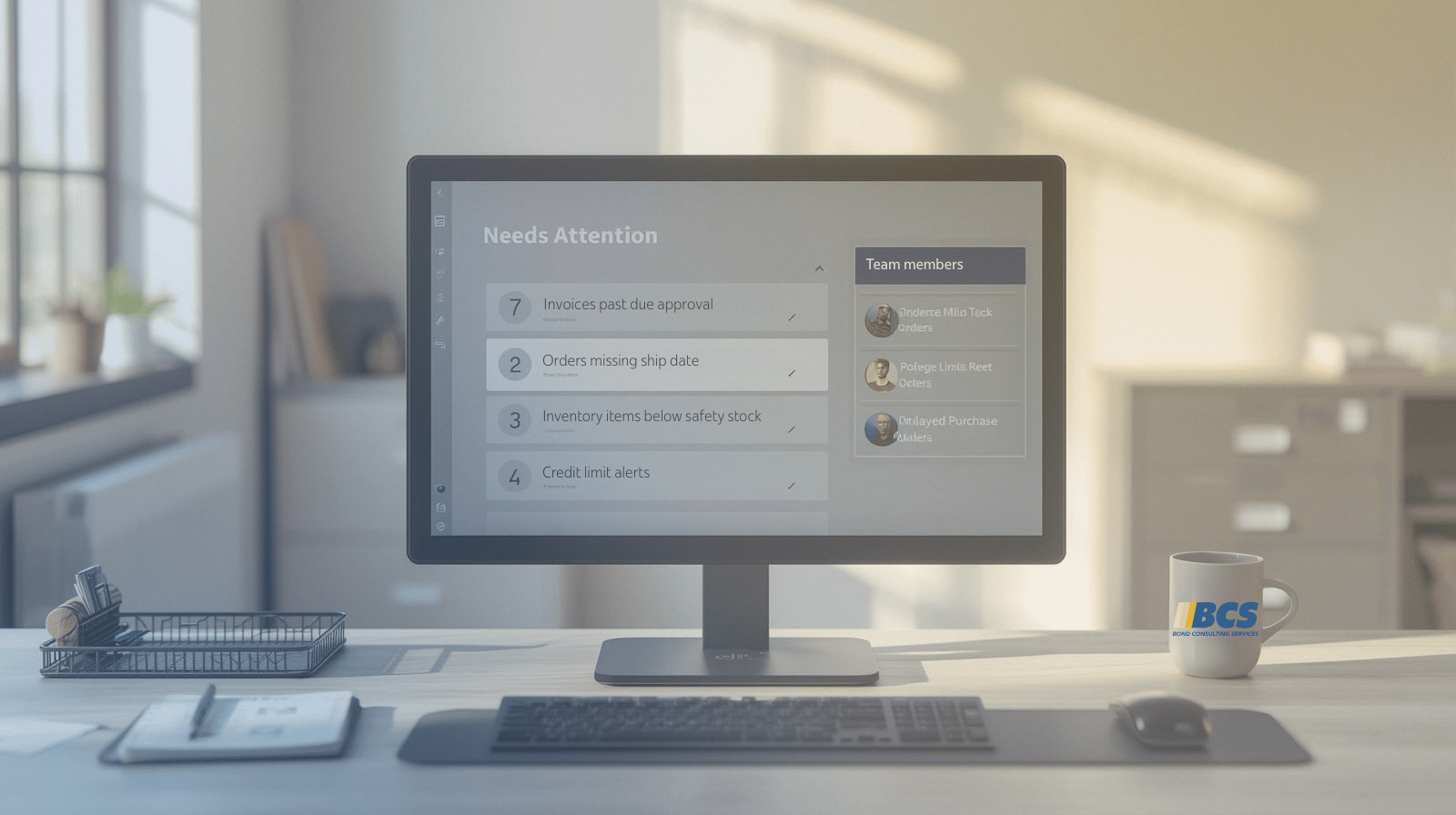

The new Copilot feature with bank recs brings three interesting functions to assist accountants.

1. Match Transactions using Copilot

Before Copilot, Business Central provided their Match Automatically function which used both transaction amount and date as data points to determine matching values. The feature “worked” but consistently left many transactions unmatched. This required users to manually match the remaining transactions.

With Copilot, Business Central will first run Match Automatically as normal. Once complete, all remaining transactions are reviewed by Copilot with a set of rules that compare descriptions and historical postings to provide even more matched transactions. With use, Copilot will start to identify patterns and provide suggestions based on previously posted reconciliations. Copilot will even remember those pesky bulk transactions that need to be matched to one single entry line.

2. Edit Suggested Matching with Copilot

Before Copilot, Users were not provided with the ability to make edits while using the Match Automatically feature. Aside from date tolerance, no other options were provided to users who executed the action. Now, Copilot will provide users with the ability to first delete any suggested matches that are incorrect. Doing this will help the intelligent assistant understand what things should not be suggested in the future.

3. Discrepancy Recognition & GL Suggestions thanks to Copilot

Finally, once the transactions in Business Central are matched, there may be a need to post entries which are missing. Things like bank fees are common and typically not recognized by accountants until the bank statement is provided. With Copilot, Business Central will now determine which transactions are missing and even suggest GL accounts to use. The suggestions are based on the transaction description and general ledger account name. For example, if the transaction details on your bank statement reflect, “Bank Fee”, Business Central will suggest a Fees and/or Penalties general ledger account.

How to Trigger Copilot

There are two areas to trigger Copilot to help with your Business Central Bank Recs.

1. Before Bank Statement Import

Business Central Copilot is ready to assist you immediately with your Bank Rec. By navigating to the Bank Account Reconciliation section of Business Central, you’ll be met with Copilot on the list screen. Select the Reconcile feature to choose the bank account and import your statement.

* Note: If a bank account statement format is not assigned on the Bank Account Card, you’ll first need to either link your bank through one of the available third party services or setup a bank statement import file.

Once imported, BC will create a reconciliation journal based on what it believes are the statement ending date and balance. Users must click Generate to confirm the suggested creation of a Bank Reconciliation journal.

After confirming, a breakdown will be displayed on which transactions were auto-matched (Match Automatically feature) vs Copilot. Users can then un-match Copilot suggested transactions (“Delete Line”), apply suggested matches (“Keep it”) or delete the entire batch (“Discard it”).

Another feature Microsoft added is the Post if fully applied option (below Statement Ending Balance). Once turned on, BC will automatically post the reconciliation journal if 100% of the transactions are matched.

2. After Bank Statement Import

If your bank statement is already imported to a Bank Account Reconciliation, you can trigger Copilot right on the journal page. First, open the journal you’d like to edit. Then select the Copilot Reconcile feature at the top right corner of the page.

Once the Copilot reconciliation assistant is selected, BC will provide a breakdown on which transactions were matched by auto-matched vs Copilot. Users can then un-match Copilot suggested transactions (“Delete Line”), apply suggested matches (“Keep it”) or delete the entire batch (“Discard it”).

Also available is Copilot’s Post difference to G/L account suggestion located under the Copilot drop-down menu.

Once triggered, Business Central will provide a breakdown on transactions detected as missing entries and provide a general ledger account to use. To apply the suggestion (“Keep it”), users will first need to select both a Journal Template and Batch to use for the posting.

Users can also apply a dimension(s) or a Vendor/Customer account via the Text-to-account mapping function.

Closing the Books Faster with Copilot

With all those features and more dropping, Microsoft’s Copilot is ready to level up your team. Accuracy, efficiency, and an expedited close no longer need to be stretch goals. Copilot is your untapped resource just itching to help you close faster. Business leaders who take advantage of this intelligent assistant will reap rewards unavailable to those who are late to the game. The goal post has moved significantly for Business Central accountants thanks to Copilot.

Why This Matters During Business Central Implementation

Copilot-enabled reconciliation workflows are often reviewed during a

Business Central implementation to streamline close processes and reduce manual reconciliation effort.

Need Help Enabling Copilot or Bank Recs?

If you’re evaluating Copilot for bank reconciliation or need help configuring reconciliation workflows in Business Central, our team can help.